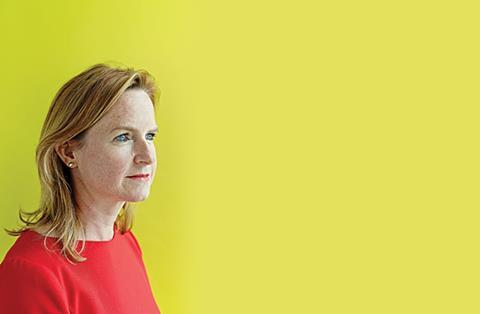

Land Securitiesā Colette OāShea is about to take over the presidency of the British Council for Offices. And she has a thing or two to say about how parts of the development industry have lost sight of the most important people - the occupiers of the buildings themselves

Since her appointment as London development director at Land Securities in 2006, Colette OāShea has been one of the most powerful clients in construction. Now promoted to managing director of London for the Ā£12bn property giant, she is overseeing the delivery of a Ā£1.5bn programme of development, all to be complete before the end of 2016, by some of the industryās elite contractors

ā including Mace, Skanska and Lend Lease.

Not content with that challenge, OāShea will this summer take on the presidency of the British Council for Offices (BCO). As the pace of the economic recovery quickens with office development activity at its highest level since 2008, she is set on using this platform to ask the development industry some tough questions about its focus on its ultimate client ā the firms who occupy its buildings.

OāShea and Land Securities set out a very clear view of the kind of accommodation post-recession occupiers are looking for. But sheās not sure the industry as a whole can honestly say it develops and builds on the basis of an in-depth understanding of its customers. In London, this apparent lack of focus is being exacerbated by the heating up of the construction market, which itself is causing rising prices, safety concerns

and an unsettling level of staff movement. So how is Land Securities approaching this, and what lessons does construction need to learn from other industries?

Land Securities was virtually the first major developer to return to the market post recession, restarting work on a wave of projects in 2010, including its most high-profile, 20 Fenchurch Street, better known as the Walkie Talkie.

Essex-born OāShea is clearly pretty pleased with this decision, which will see the developer complete a range of schemes over the next couple of years as the lettings market heats up. āWeāre in a good place in London. Everything is pretty much playing out as weād anticipated,ā she says.

Just two of Land Securitiesā pipeline of projects are yet to have a contractor appointed ā although OāShea says the firm is close to decisions on these, the 90,000ft2 Oriana retail scheme and 95,000ft2 20 Eastbourne Terrace office project.

Beyond 2016 it has no development pipeline and is pretty much out of the market for new opportunities: āWeāre not buying at the moment because itās a very hot investment market. Thereās a real demand for development land, [but] thereās only a finite amount of product,ā says OāShea. āThere are a lot of people piling in to it at the minute and weāre not going to compete at the levels that weāre seeing.ā

This leaves her with little procurement to undertake right now, something else sheās pleased about. āWe have seen rents rising, but in parallel we have seen construction costs rising. Itās a collision of the residential strain and the commercial strain on the construction industry. Thatās becoming an increasing challenge. And I think some of the big contractors, their order books are almost full.ā

Hence her focus is shifting from procurement to delivery of projects. āWeāre not sitting here twiddling our thumbs,ā she says.

The right price

Land Securities made a conscious decision to procure its current pipeline of work ā including mega schemes such as its Ā£384m Nova Victoria project in Victoria, London ā in the teeth of the recession using single stage fixed-price competitive tendering. This allowed it to secure low prices from contractors. But it is undertaking remaining procurements in a very different fashion, using two stage tendering with an element of negotiation, despite this providing challenges for it as a listed company.

āAs a Plc you need to be tendering absolutely everything but that just doesnāt fit with the market as we see it today,ā says OāShea. āSo itās trying to work out how can we merge the Plc needs with giving someone the certainty that theyāll get the job, provided we can come to the right price. So effectively youāre negotiating the price. Because what is putting people off at the moment is competitive tendering.ā

Indeed the market is now so hot in the central London geography that she works in, that she foresees a return to construction management, despite the pricing risk for clients. She says: āIf I had a project now and we were looking to procure it, then I suspect CM would be one of the routes weād be considering, but itās obviously more risky for us [in terms of price].ā

However work is procured, it is clear OāShea thinks the qualities she needs from contractors are all too rare. āWhat you want is the businesses that are able to merge really traditional contracting with modern technology. Which is actually a really difficult thing to do.

āItās about people who just know building, who can envisage how the thing fits together in their head. Thatās a very special skill. They understand the site; they live and breathe it. When you meld that with cutting edge technology then youāve got a very powerful combination, [but] I think thatās where people struggle.ā

She wonāt say which firms she thinks offer this, though she says she can be judged by her record ā in recent years Land Securities has offered its prize London jobs to Mace, Skanska, Sir Robert McAlpine and Lend Lease ā though 20 Fenchurch St is being built by Canary Wharf Contractors as Land Securities is partnering with Canary Wharf Group on the development.

A certain quality

The difficulty in finding people with the right skills is not limited to builders, though, with the resurgence in the market creating instability as consultants start to vie for the most talented staff. āWeāre back to a place where anybody that is talented within the construction development sector is in demand. Particularly in the construction industry weāre seeing a lot of shifting between the various businesses.

āWhat that brings as a client is a lot of instability and uncertainty, so thatās a risk. Itās very unsettling because youāre reliant on your teams ā whether theyāre internal or external ā you want the same people round the table. And itās all putting pressure on the cost base.ā

This feeds in to her wider view of the development industry as a whole not always focusing on its customers. OāShea speaks articulately and confidently and while you would not describe her as outspoken, she is evidently not frightened of challenging her peers in the development industry to do better.

She says: āOne of our customers said to me the other day āwho are the architects designing for ā themselves or us?āā

Itās a problem OāShea clearly believes can be applied to architects widely. āI think it absolutely is a fair criticism,ā she says.

But where does a focus on buildingsā occupiers take the industry? OāShea says the demand, emerging from recession, is still for cost-effective space. But that doesnāt mean low-spec or cheap ā quite the opposite ā it means optimising the building for maximum possible occupancy and productivity.

āWhat office occupiers are looking at is the cost per head, so then it comes back to the efficiency point,ā she says. āIf youāve got 20,000ft2 of space, how many people can occupy that space? And actually if you want to optimise that, you do need really high-spec. You canāt cut back if you want to achieve high densities. Itās everything from the lifting capacity of the building, to the air handling, to IT infrastructure.

āWeāre responding to a world where our expectation, that the cost per head would be going down because people would be working from home, actually doesnāt work. We do want to come in and occupy space, but that space will be used differently.ā

She cites both Land Securitiesā own Walkie Talkie, and Derwentās stripped back āWhite Collar Factoryā concept in Old Street as instances where the industry has thought hard about specific usersā needs. But this doesnāt always happen.

Keep the customer satisfied

āIf we as an industry donāt think about our customer at all times within every segment of it, we wonāt have a sustainable model. There are many other industries that havenāt kept tabs on what their customers have done and theyāve gone. You look at some of manufacturing, where they are looking and understanding what their customer wants daily. From the widgets, to the colours ā constant customer feedback that is informing their product.

āI am a customer of a contractor, but the ultimate customer of both contractor and Land Securities is the end user, and so itās about the industry remembering that, so that theyāve always got the end user in mind when theyāre building out.ā

She seems to have a particular concern here around architects, adding this advice is āreally relevant for the design industryā.

Indeed, for her, the current debate over the planned proliferation of tall buildings in London is more a question about the design quality of the proposed towers than their height or specific location.

āLondonās success has been its ability to have historic buildings sitting among beautiful modern buildings. If youāre working around listed buildings, that absolutely should and must be respected, and viewing corridors are important and should be respected. I donāt think weād be where we are today if our policies around heritage werenāt working.

āI wonder whether the biggest challenge is the design quality challenge ā how do you ensure that every building is absolutely of the best quality for whatever its use is?ā

OāShea will have a year at the BCO to develop this theme, after being formally announced as president at the organisationās annual general meeting in July. The construction industry would be well advised to listen.

BCO conference

The BCO conference takes place in Birmingham on 14-16 May. For more information or to book a place go to www.bco.org.uk. ŠŌ°ÉµēĢØ is a media partner for the event.

1 Readers' comment